- ● 3000+ games including Stake Originals

- ● Exclusive VIP Club with 4 tiers

- ● C$75k weekly raffle giveaway

- ● Responsive 24/7 live chat support

- ● 39+ leading software providers

Bitcoin casinos available to Canadian players, offer features, such as instant withdrawals, anonymous payments, and worldwide access. In this guide, our experts will share with you the list of the best crypto casinos in Canada, explain which cryptocurrencies are most popular and what are the best gaming options.

After carefully collecting and analyzing user reviews, we have crafted a list of the top 8 best Bitcoin casinos in Canada. We prioritized user experience, drawing from both our evaluations and feedback from seasoned players on sites like Trustpilot.

What users like:

What can be improved:

❌ Information about fees and limits could be more transparent.

Cloudbet made it to the top of our list thanks to the myriad of positive reviews from active users praising its cashback on every bet, charge-free blockchain transactions, and an accessible 0.00000831 Bitcoin minimum withdrawal limit. Users also praised the security and support teams, noting how fast they received replies as well as the level of security featured on the platform.

What users like:

What can be improved:

❌ At least 1x deposit turnover to withdraw funds

We ranked BitCasino so highly thanks to the number of 5-star user reviews praising its game selection, support team, and fast withdrawals. We’ve also seen a number of reviews highlighting its Metaverse FAQ that serves as the ultimate guide to learning more about cryptos with easy-to-understand examples and an engaging blog. Our team rated Bitcasino 7.8/10, which isn’t too far away from the 4.5/5 given by Trustpilot.

What users like:

What can be improved:

❌ Limited selection of cryptocurrencies compared to other casinos

Offering a stacked gaming portfolio and a comprehensive sports betting platform, Winz.io offers all of your Bitcoin gambling needs in one convenient place. Active users raved about the quality of the support team, rakeback bonuses, and fast transactions. While we loved the 24/7 support options and our team always felt secure thanks to the state-of-the-art encryption software, resulting in our 7.0/10 rating that is only slightly lower than the 4.3/5 provided by Trustpilot reviewers.

What users like:

What can be improved:

❌ Only 6 crypto choices

We found plenty of real users who were blown away by the sheer number of gaming options at the site, including live casino games, Megaways slots, jackpot slots, hold & win slots, and Lucky Picks. During our review, the team appreciated the yellow and black color design but felt the layout could be more user-friendly, resulting in a 6.5/10 rating. However, the majority of users praise this brand as the 'most user-friendly slot site,' offering a different perspective.

What users like:

What can be improved:

❌ Cashback bonuses come with wagering requirements

Bets.io offers an impressive range of digital currency options, attracting users who appreciate the flexibility to choose the currencies they are most familiar with and trust. Long-term users particularly valued the seamless payment system, the generous loyalty program, and the diverse payment options, all of which contributed to a satisfying and user-friendly experience. While users praised the wide selection, some found it could be easier to navigate and locate their preferred games.

What users like:

What can be improved:

❌ Bonuses are sticky, you play for real money first

Reviews from frequent players highlight the site's usability, particularly emphasizing the separate menu widget for purchasing digital currency through an exchange service within the platform. Users also noted that the footer contains a link to a crypto guide, explaining how to use Bitcoin at the casino, making it more accessible for beginners. They also pointed out the variety of bonuses and promotions available, as well as the quality of customer support options.

What users like:

What can be improved:

❌ No standard welcome bonus

There are plenty of reviews about Stake Casino, usually praising its convenient options for buying cryptocurrencies directly on the site. Additionally, long-term users highlight the most favorable feature of the site: the absence of limits for blockchain payments, which makes Stake Casino suitable for any bankroll. Trustpilot users were also impressed with the payout speed, which is processed in 0 to 30 minutes on average, collectively rating it a 3.7/5.

What we like:

What can be improved:

❌ Selling digital currency on the platform applies a 0.1% Withdrawal Fee.

Our experts consider BC.Game to be one of the best casinos that accepts Bitcoin, thanks to its wide range of unique crypto-focused features. These include its own BC Dollar (BCD) coin, support for 18 different digital currencies, and active communities on crypto-focused platforms like the Bitcoin Talk forum. We found this platform extremely convenient, giving it a rating of 5.7/10, which is significantly higher than the 2.3/5 rating on Trustpilot. While there have been some complaints, it's evident that BC.Game is actively addressing these issues and shows a genuine commitment to improving the quality of their platform.

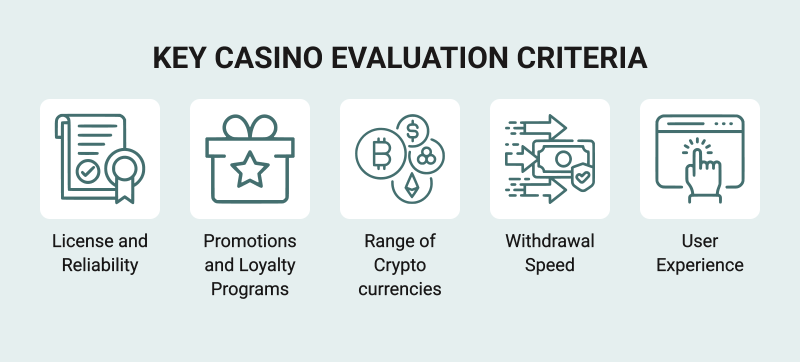

While our team of experts have recommended a list of the best Canadian Bitcoin casinos, we want to make sure you have everything you need to conduct your own research. To that end, here's a summary of features we recommend evaluating when reviewing Bitcoin casinos:

License and Reliability – We recommend only playing at a casino if it has a valid licence from a recognised gambling authority, such as the MGA or the Kahnawake Gaming Commission. Each licensed casino has information about its license at the bottom of the page, so you can check for yourselves.

Promotions and Loyalty Programs – Bonuses are an important part of the online casino experience, so evaluate each offer available at your casino. Look for crypto-specific promotions that offer increased rewards for casino deposits, as well as VIP programs that reward loyal players.

Range of Cryptocurrencies – We recommend looking at the variety of different digital currencies available for deposits and withdrawals. Focus on the major options, such as Bitcoin, ETH, and LTC, as well as custom gambling coins such as DICE, BCD, and RLB.

Payout Speed – Find information about the withdrawal speeds of each cryptocurrency to give you an idea of which options are best, as well as info on how easy it is to make a transaction and if there are any transaction fees. The best casinos provide withdrawals in 4 hours or less.

User Experience With the Platform – Take the time to navigate around the casino’s site, as this will give you a solid idea of what it’s like to use the site when you join. We also recommend consulting platforms such as TrustPilot and Reddit to get first-hand accounts of long time players.

Game Library – Casinos that feauture thousands of unique games from some of the industry’s top software providers, can give you plenty of choices when you sign up. Look for the variety of games available to ensure that the site offers games you want to play.

Customer Support – Ideally, a casino should have customer support representatives available 24/7 to assist you whenever you need them. Check out the support options to see how easy they are to use and what times they’re available.

Site Security and Player Safety – Look for casinos that go above and beyond in their security measures. Sites with the latest encryption, data protection best practices, and responsible gambling tools are the best places to play.

During our research, we've found that Bitcoin casino sites offer a variety of benefits to Canadian casino players that may not be offered by conventional casinos. These include:

One of the advantages of Bitcon casinos over traditional casinos is withdrawals that are measured in hours rather than days. Even the slowest cryptocurrencies have their transactions fully confirmed within a few hours, which is faster than many of the payment methods offered at traditional fiat casinos.

Compared to fiat casinos, many of the best crypto casinos offer comparatively lower transaction fees. The most you can expect to pay for a crypto transaction is a couple of bucks, even if you're depositing thousands of dollars. While this depends on how heavy the network traffic is at the time, it still compares favourably to a flat percentage that some casinos charge for fiat transactions.

Let's look at a comparison table to examine the difference:

| Casino | Deposit Amount | Fee | Total Deposit |

| Crypto | $5,000 | $3 | $5,003 |

| Fiat | $5,000 | 3% | $5,150 |

As you can see, you can make significant savings by choosing to play at Bitcoin casino sites in Canada if you frequently make large transactions.

While researching and testing Bitcoin casinos in Canada, we found that the bonuses offered by these sites often far exceed those offered by regular casinos. For example, MoonWin Casino offers a regular package of up to C$10,000 and 180 free spins; however, crypto players can claim up to 1 Bitcoin a day, which is significantly higher than the fiat offer.

Another benefit offered by the top Bitcoin casinos is their accessibility. These casinos typically operate in unrestricted markets that allow players to access online Bitcoin casino sites from all over the world. Many licensing bodies restrict traditional online casinos to specific markets, meaning that you can't play while travelling abroad. An exception for Canadian players is the Ontario online gambling market, where regulatory limitations on crypto apply.

Arguably the biggest benefit that a Canadian Bitcoin casino can offer is privacy. Digital currencies such as Bitcoin run on the blockchain, a trustless, peer-to-peer payment system that does not require the user to create an account. This means you are able to purchase and transfer crypto without having to disclose your personal information.

Expert Note

While cryptocurrencies allow you to transfer funds without disclosing your personal information, the majority of online Bitcoin casinos require players to complete KYC verification as part of their licensing requirements.

Many players enjoy playing at new casinos, as they often come with a unique gimmick or feature that helps them stand out from the crowd, such as enhanced casino bonuses or VR games. To bring you the very latest Bitcoin casinos, we employ a team of experts who keep their finger on the pulse, testing new sites every month and recommending the best of the best.

So, if you want to try the best new casinos of 2025, check out our list below.

| Crypto casino | Welcome Bonus | Cryptocurrencies | Launch Year | Play Here |

|---|---|---|---|---|

|

Welcome Bonus: max. 100% up to C$2,100 | BTC, BCH, ETH, LTC, DOGE, USDT | 2024 | Play Here |

|

Welcome Bonus: max. 100% up to C$2,800 + 300 Free Spins | BTC, ETH, LTC, DOGE, USDT, XRP, BNB, ADA, TRX | 2024 | Play Here |

|

Welcome Bonus: max. 100% up to C$4,000 + 475 free spins | BTC, LTC, ETH, DOGE, TRX, USDC, ADA, XRP | 2024 | Play Here |

|

Welcome Bonus: max. 100% up to C$5,800 + 1,200 free spins | BTC, BCH, ETH, LTC, DOGE, USDT, XRP, USDC, TRX, BNB, ADA | 2024 | Play Here |

|

Welcome Bonus: max. 150% up to C$25,000 + 1,000 Free Spins | BTC, BCH, ETH, LTC, DOGE, USDT, XRP, USDC, TRX, BNB, ADA, DAI | 2024 | Play Here |

The best cryptocurrency casinos in Canada allow transactions with a wide variety of crypto coins. Each option offers different transaction times, block sizes, and fee structures, so you can pick the option that best suits your needs. We've broken down the most popular options below.

One cryptocurrency you can expect to find at every crypto casino online is Bitcoin. On average, the Bitcoin blockchain takes around 10 minutes per confirmation, meaning that most transactions are fully completed within 1-2 hours. The average fee for a Bitcoin transaction is $3, although this can vary depending on the level of network traffic. Many crypto casino players choose to use Bitcoin as it's the best-known cryptocurrency and it has a high level of trust within the community.

While Bitcoin and Bitcoin Cash sound similar these are two different cryptocurrencies. Bitcoin Cash was created after a hard fork of the Bitcoin blockchain in 2017, hence the derivative name. The fork increased the block size limit from 4MB to 32MB. This allows more transactions to be processed at once, decreasing the effect of network traffic and lowering transaction fees. Bitcoin Cash transactions take around 1-2 hours to be fully confirmed.

Ethereum casinos can operate their casino games directly on the Ethereum blockchain, allowing players to connect their wallets and directly interact with the platform. Ethereum offers fast transaction times; each block takes around 13 seconds to confirm, meaning that most transactions are fully confirmed within 5 minutes. The fees for sending Ethereum from one wallet to another are often quite low, typically costing around $0.50.

Litecoin is often accepted at the best Bitcoin and crypto casinos in Canada and is a popular option due to its longevity and increased performance. Litecoin offers transaction speeds 4 times faster than that of Bitcoin. It only takes around 2.5 minutes for each confirmation, meaning that most transactions are fully confirmed within 15-20 minutes.

Originally developed as a meme-coin back in 2013, Dogecoin has gained traction as a legitimate cryptocurrency. Each block confirmation only takes around 1 minute, meaning transactions can be fully confirmed within 5-6 minutes, and the average fee can range from a fraction of a cent to 20 cents, depending on network traffic.

The best casinos provide their players with a host of other digital currencies to choose from alongside the most popular options. This list can include, but is not limited to:

Each of these cryptocurrencies offers benefits to casino players, whether it's low fees, fast transactions, or a stable price. Picking the right crypto to make your deposits comes down to what you want from a payment method, so take the time to evaluate your needs and find a payment method that matches those needs.

While mainstream cryptocurrencies such as the ones listed above are found at the majority of online crypto casinos, some sites have launched their own tokens, specifically for use on their platform. These site-specific tokens offer numerous benefits to players, including allowing the user to receive a percentage of their rakeback, discounts on trading fees, and the opportunity to enter lotteries.

Examples of these dedicated gambling cryptocurrencies include:

Did you know?

Bitcoin is the first cryptocurrency to have launched back in 2009, created by an anonymous cryptographer who goes by the pseudonym Satoshi Nakamoto. It has the largest market cap of any cryptocurrency, currently sitting at $1.16 trillion, and is the most widely accepted currency at Canadian crypto casinos.

Depositing at a crypto or Bitcoin casino takes a few simple steps. To learn how to use Bitcoin and other cryptocurrencies to find your casino account, follow the instructions below.

Purchase Cryptocurrency - If you do not currently own any crypto, you must first purchase some via a crypto exchange. We recommend choosing one of the most popular exchanges such as Coinbase, Binance, or Crypto.com, as they are highly secure and are trusted within the community.

Transfer Your Coins Once you have purchased your cryptocurrency, you must transfer it to your personal wallet. There are many wallet options available depending on which cryptocurrency you purchase, but we recommend using a desktop wallet that allows you to easily make and receive transactions on your PC.

Choose Your Casino - Take a look at our recommended list of new Bitcoin casino sites and choose the one that most appeals to you. Read through the welcome bonus T&Cs to determine whether or not you'd like to join.

Create Your Account - Complete the sign up procedure by filling out the provided forms.

Open The Cashier - Once your account is up and running, go to the Cashier section and choose your preferred cryptocurrency.

Enter Your Deposit After choosing your payment method, enter how much you'd like to deposit. The casino will convert your deposit amount into the crypto of your choice and display how much you need to send along with the casino's wallet address.

Go To Your Wallet - Open your crypto wallet and start a new transaction. Enter the amount you'd like to send and input the casino's wallet address in the "To:" section. You must enter the wallet address correctly; any small mistake and the casino will not receive your deposit. Approve Your Transaction if all is coorect.

Once you're ready to withdraw your winnings, you'll find that withdrawing from a casino that accepts Bitcoin is just as easy as depositing. Simply follow the guide below to make your first Bitcoin casino withdrawal.

Visit The Cashier - Log into your Bitcoin casino account and go to the Cashier section. Select the Withdrawal option to start the process.

Choose Your Payment Method - Most Bitcoin casino sites require you to withdraw using the same currency you used to deposit. If your casino allows you to withdraw using an alternative method, pick your preferred option.

Enter Your Withdrawal - Input how much you'd like to withdraw from your casino account, ensuring it meets the minimum withdrawal requirements.

Input Your Wallet Address - Enter your wallet address. Make sure that you have correctly copied your wallet address; if you make a mistake, you will not receive your withdrawal.

Approve Your Withdrawal - Check your withdrawal details, ensuring that both the amount and your wallet address are correct, then approve your transaction.

Similar to fiat casinos, Bitcoin casinos exist on a spectrum of safe and unsafe. Just because a casino is a crypto casino, it doesn't make it inherently safe or unsafe, you need to weigh up the factors of each site to determine how safe it is.

While reviewing Bitcoin casinos, we found that the best sites all offered the following:

Canadian residents are legally allowed to buy and sell cryptocurrencies such as Bitcoin in Canada. Crypto assets are considered an investment vehicle by the Canadian government and are not considered legal tender. Your deposits are not covered by the CDIC and are not covered by federal or provincial deposit insurance plans.

While you are not required to pay taxes on gambling winnings in Canada, you will be required to pay capital gains tax if you sell your digital currency for a profit.

Gambling at Bitcoin casinos in Canada can be a confusing topic to parse due to the legal jargon that's used in the country's laws. After reading through the laws ourselves, we can report that as of 2024, crypto gambling is legal for Canadian residents, as there are no laws that explicitly prevent players from accessing Bitcoin casinos.

Before deciding whether or not to play at casino sites that accept crypto and Bitcoin deposits, it's important to weigh up the pros and cons. Below we've listed the key advantages and disadvantages of crypto casino sites, giving you all the info you need to make an informed decision.

Did you know?

Bitcoin is not subject to inflation at the same rates as fiat currencies. Since Bitcoin launched in 2009, the spending power of the Canadian dollar has decreased by 40%, whereas the value of Bitcoin has increased by roughly 8.8 billion percent.

One of the many advantages that comes with playing at Bitcoin casinos is the access to generous welcome bonuses and promotions. To help you understand the different types of bonuses available at Bitcoin casinos, we've broken down the most popular offers below:

| 💰 Matched Deposit | The most common type of welcome bonus found at Bitcoin casinos is the matched deposit bonus. These bonuses offer you a percentage of your deposit in bonus funds, up to a maximum amount. For example, a welcome bonus may offer you a 100% matched deposit bonus up to $2,000; if you deposit the full $2,000, you'll receive an extra $2,000 in bonus funds, giving you a total of $4,000 to play with. |

| 🎰 Free Spins | Another common welcome bonus offered at best crypto casino sites is the free spins bonus. This type of bonus allows you to play real money slot games without risking your bankroll. The amount of free spins typically ranges between 20 and 250. |

| 💸 Cashback | Rather than give you bonus funds after depositing, a cashback bonus will refund any losses you incur over a set period of time. This allows you to gamble while safe in the knowledge that any losses will be returned to your account. |

| 🎉 No Deposit | Arguably the most popular Bitcoin casino welcome bonus is the no deposit bonus. These bonuses offer rewards such as free spins, free bets, or bonus funds without needing to make a real money deposit. They're a great way to try out new games or test an online casino without having to risk your hard-earned money. |

| 🔄 Reload | Available to existing players, these bonuses offer incentives to reload their accounts. These incentives can come in the form of free spins, matched deposit bonuses or cashback. Based on our research, the value of reload bonuses is typically lower than that of welcome bonuses. |

The best casinos provide a selection of games for you to enjoy that encompass a wide range of genres. After reviewing multiple sites, we've found that the majority of crypto casinos provide thousands of high-quality games developed by some of the industry's top software providers.

Below, we've highlighted some of the most popular gaming options found at Bitcoin casinos:

Crypto roulette is a popular casino game where players bet on where they think the ball will land. The game plays identically to traditional roulette; the only difference is that players make their wagers using digital currencies such as Litecoin or Bitcoin. Roulette appeals to casino players thanks to its selection of gambling options, fast-paced action, and easy-to-understand rules.

Bitcoin poker can come in one of two formats; casino poker games, or traditional poker games. Traditional poker games are games played against other players using digital currencies such as Bitcoin. Examples of these games include Texas Hold'em, 5-card Draw, and 7-card Stud. Rather than playing against the house, players play against each other, with the casino taking a small percentage of each pot.

The more common form of Bitcoin poker is poker casino games, such as Caribbean Stud, 3-card Poker, and Video Poker. These games are played against the house and are more similar to other casino games such as blackjack and baccarat.

One of the most popular casino games at crypto casinos, Bitcoin slots are online slot games that can be played with cryptocurrencies such as Bitcoin. The best casino sites offer hundreds, if not thousands of Bitcoin slots, each with a unique theme, design, or gameplay feature.

Slot games are popular as they don't require the player to learn any dedicated skills or strategies to play. They may also offer large jackpot prizes or extremely low house edges, depending on the specific game.

Live casino games offer a next-level gaming experience that recreates the feeling of playing at a brick-and-mortar casino. Typically based on table games such as blackjack, roulette, and baccarat, these games use professional dealers and genuine casino equipment to provide an authentic casino gaming experience from the comfort of your own home.

The best Bitcoin casinos Canada has to offer provide their players with state-of-the-art mobile gaming platforms that allow them to gamble on the go. These platforms can come in one of two forms: a mobile-optimized casino website, or a dedicated crypto casino app.

A mobile-optimized casino website allows players to play casino games directly in their mobile browser. Dedicated apps must be downloaded onto your mobile device, and can often be found in your app store. While these apps require regular updates, they often match the performance of desktop sites and offer a larger range of games.

CryptoLeo is a relatively new crypto casino that offers up to 5,000 USDT as a welcome bonus. Plus, you can enjoy your favorite games on a dedicated mobile app!

Go to CryptoLeo CasinoMany casino players opt for conventional fiat payments like debit cards or e-wallets due to their accessibility and immediate availability of funds. To assist in choosing the best payment method, we've compared popular options against cryptocurrencies.

| Payment Method | Deposit Speed | Deposit Limits | Withdrawal Speed | Withdrawal Limits | Fees |

| Crypto | 0-10 minutes | No Limits | 10 minutes-4 hours | No Limits | $0-$5 |

| Credit/Debit Cards | Instant | $10/$10,000 | 1-3 Business Days | $10/$10,000 | 0-4% |

| E-Wallets | Instant | $5/$10,000 | 24 Hours | $5/$10,000 | 0-4% |

| Prepaid Cards | Instant | $10/$250 | N/A | N/A | 0-4% |

| Bank Transfers | Instant | $10/$10,000 | 3-7 Business Days | $10/$10,000 | 0-4% |

What is a Crypto Casino?

A crypto casino is an online casino that accepts cryptocurrency payments, such as Bitcoin, Ethereum, and Litecoin. However, "crypto casino" is rather a vague term. Among many casino players, the terms "Bitcoin casino" and "crypto casino" are often used interchangeably. Therefore, if you see the term "Bitcoin casino" used in this text or elsewhere, you can be confident that it is the same thing as a crypto casino.

What are the best crypto casinos?

After our review, experts ranked BitCasino as the best crypto casino in Canada. However, based on user opinions, Cloudbet is equally impressive. Both casinos stand out for their wide range of crypto payment options, extensive gaming libraries, generous bonuses, and user-friendly designs. These factors make them top choices for players.

Is crypto gambling legal in Canada?

After researching Canadian laws, we have found no law that explicitly prevents Canadian residents from gambling online at crypto casinos. While it is illegal for casinos to offer games to Canadian players without a valid Canadian licence, Canadians are not banned from accessing these sites.

How do you play with crypto at casino sites?

The easiest way to play with crypto at an online casino is to use it as a deposit method. Simply log on to your casino account, select your preferred digital currency from the list of options, and follow the instructions to deposit. Once your deposit has been processed, you can use it to start playing your favourite casino games.

What bonuses can I get at Bitcoin casinos?

Bitcoin casinos provide their players with a variety of bonuses and promotions that can be claimed as a new or existing player. Some of the most popular casino bonuses include matched deposit bonuses, cashback bonuses, and free spins bonuses.

What cryptocurrencies are available at online casinos?

The best crypto casinos give players a wide selection of different digital currencies across multiple blockchains. Some of the most widely available options include Bitcoin, Litecoin, Ethereum, Bitcoin Cash, and Dogecoin.

What's the best crypto wallet for gambling?

The best crypto wallet for gambling is one that is easily accessible while remaining secure. Cold wallets are the most secure option, but they're inconvenient to use on a regular basis. We recommend choosing a hot wallet that can be downloaded and installed on your PC or mobile device. This gives you instant access to your crypto wallet, allowing you to quickly deposit and withdraw while playing at a crypto casino.

What games can I play at Crypto online casinos?

You can play a variety of games at our recommended casinos. The best sites offer thousands of unique games, giving you plenty of options when you sign up. Some of the most popular games include slots, table games, instant win games, and live casino games.

Can I play games at online casinos using different cryptocurrencies?

Almost all crypto casinos provide players with multiple deposit options. This allows you to make multiple deposits and play casino games with different cryptocurrencies.Almost all crypto casinos provide players with multiple deposit options. This allows you to make multiple deposits and play casino games with different cryptocurrencies.